“The rationale to screen the resultant list of stocks for a minimum pre-tax RoCE of at least 15 percent in FY18 is to identify firms that would at least meet the cost of capital,” said the report.

After a steep correction in valuations of small and midcaps in the last one year—25 percent fall in BSE Smallcap index on P/B compared to 9 percent dip in Nifty—valuations have become attractive for some small-caps.

Using a combination of top-down qualitative and quantitative parameters, Ambit Capital has identified high-quality businesses in midcaps with sound fundamentals that are trading at attractive valuations to historical averages.

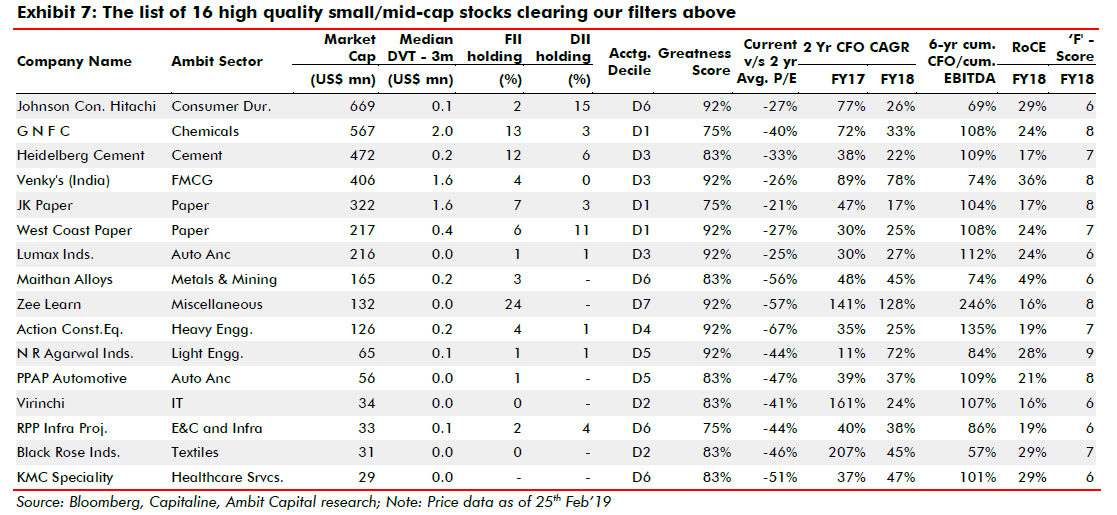

The brokerage house highlights 16 stocks that clear their cut-off of 15 percent RoCE, cash flow quality and growth, Piotroski’s ‘F’ score and filters on accounting and greatness.

Ambit Capital arrived at a list of 16 companies that clear the filters with an average FY18 RoCE of 24 percent and 6-year cumulative CFO/EBITDA of 105 percent. Although it also says that some of the names are fairly illiquid and do not seem to be widely held by institutional clients, but they are a good starting point for a further deep dive.

The list includes Hitachi, GNFC, Heidelberg Cement, Venky’s, JK Paper, West Coast Paper, Lumax Industries, Zee Learn, PPAP Automotive, RPP Infra, and KMC Speciality.

Ambit Capital has used a 6-step process to identify quality small and mid-cap stocks in the listed universe with a market capitalization less than $3 billion.

The first step is to screen the listed universe for small and mid-cap stocks. The next step is to scan for decent quality which is quantified using ‘HAWK’ scores—an in-house parameter. The third step is to shortlist firms that are trading at cheap valuations.

The fourth step is to shortlist firms with a history of a healthy cash flow generation, and the fifth step is to use Piotroski’s F-score to gauge improvement in the financial health of a firm.

The final step involves screening for firms with pre-tax RoCE of at least 15 percent. RoCE is the return on capital employed. It is a metric that measures a company’s profitability or efficiency with which its capital is employed.

“The rationale to screen the resultant list of stocks for a minimum pre-tax RoCE of at least 15 percent in FY18 is to identify firms that would at least meet the cost of capital (which for the vast majority of listed companies is at least 14 percent),” said the report.

History suggests that superior accounting quality firms continue to outperform poor accounting quality firms in the long run as is evident in performance differential for ‘Zone of Safety’ over ‘Zone of Darkness’.

When shortlisting stocks that are trading at cheap valuations, Ambit has filtered firms that are trading at a discount of at least 20 percent to the last 2-year average valuations on P/E to shortlist names that are currently trading at relatively attractive valuations.

For more trading tips find Best advisory company in Indore

Comments

Post a Comment