The S&P BSE Midcap index slipped 0.57 percent for the week ended May 17 while the S&P BSE Smallcap index was down 1.5 percent in the same period.

It was a roller coaster ride for the Indian markets as Nifty made an intra-week low of 11108 before closing above 11400 levels for the week that ended May 17. The index rose 1.14 percent in just 5 trading sessions while the S&P BSE Sensex gained 1.25 percent in the same period.

The broader market, on the other hand, underperformed benchmark indices ahead of the crucial exit polls which are scheduled to be out on Sunday, May 19.

The S&P BSE Midcap index slipped 0.57 percent for the week that ended May 17 while the S&P BSE Smallcap index was down 1.5 percent in the same period.

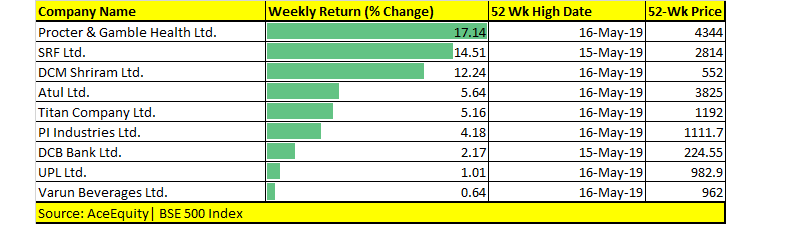

Even though benchmark indices struggled to gain momentum, as many as 9 stocks in the S&P BSE 500 index bucked the trend to hit fresh 52-week high which includes names like Procter & Gamble Health, SRF, DCM Shriram, Atul, Titan Company, PI Industries, DCB Bank, UPL, and Varun Beverages.

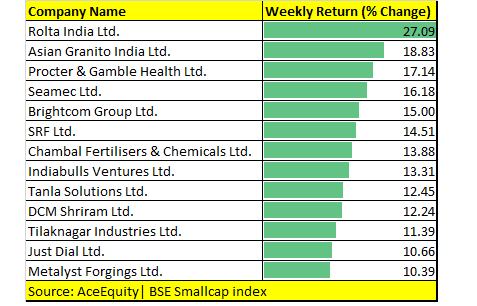

In the S&P BSE Smallcap index, which fell by over 1 percent, as many as 13 stocks rose 10-30 percent which include names like Tanla Solutions, JustDial, Indiabulls Ventures, Asian Granito, Rolta India, etc, among others.

All eyes are on exit polls results which will chart the direction of markets in the coming week ahead of election results which will be out on May 23, Thursday. Investors should brace for volatility as we could see wild gyrations in the market.

But, the way markets bounced back on Friday with huge gains suggest that D-Street is factoring in a positive outcome or at least a stable government at the center.

"The last phase of the election will be over on Sunday and exit polls from different surveys will be out from Sunday night. The market is expecting the current regimen to continue for next term and will not be surprised if exit polls share this view," Romesh Tiwari, Head of Research, CapitalAim told Moneycontrol.

"But, in case of exit polls predicts a hung assembly or significant decline in NDA seats then NIFTY and Sensex may become highly volatile before actual result to be declared on 23rd May," he said.

Technical View:

The Nifty formed a bullish candle on the daily charts and a Hammer kind of candle on the weekly charts which suggest that bulls might make a comeback. The Nifty50 reclaimed crucial resistance levels in Friday's session which is a positive sign for the bulls.

The Nifty witnessed a gradual rise throughout the day on Friday. On the way up, the index crossed the swing high of 11,294, as well as 11400 levels.

"In the coming week, we believe the trend may continue in favor of bulls if Nifty is able to close above 11550. Above that (11550), we may see a sharp move and short covering that can thrust and take Nifty to 11750 - 11800 in a furious way," Mustafa Nadeem, CEO, Epic Research told Moneycontrol.

"On the downside, we are well supported at 11150 - 11100 range; so any decline towards these numbers shall be utilized by bulls," he said.

for more information best advisory company in Indore

Comments

Post a Comment